Life at Night in the Creative Capital

Insights into Providence’s Life at Night Economy

2024

Translatable and ADA Accessible Webpage Version

Letter from the Mayor

Providence is a vibrant city that offers a diverse range of cultural attractions and activities, while providing a high quality of life for people who work within and outside of traditional 9-to-5 hours. These attractions complement the work that takes place during the day at colleges, universities, manufacturing facilities, small businesses, and hospitals. Providence is truly a 24-hour city, with a dynamic nighttime workforce to support it. That is why we are excited to leverage the data and feedback compiled in Life at Night in the Creative Capital to improve and tailor our city services to better suit the needs of Providence’s Life at Night economy and industries.

This study was initiated in response to concerns raised by residents during the 2019-2021 cultural planning process led by the Department of Art, Culture and Tourism for PVDx2031: A Cultural Plan for Culture Shift. Many of its recommendations reflect the calls from our community for support and increased access to information and resources. JS&A conducted bilingual surveys with Life at Night business owners, held focus groups and one-on-one interviews with local experts and neighborhood stakeholders, and aggregated third-party economic data and information from previous studies. They then used their extensive expertise to make recommendations based on promising practices nationally and internationally.

For people of all ages, life at night is central to their overall quality of life. By addressing the specific needs and experiences of the workers and businesses that comprise the City’s Life at Night economy and balancing the needs of our neighborhoods, we can ensure that Providence remains a place that people want to live, work, and play throughout the day.

Brett P. Smiley

Mayor of Providence

Table of Contents

Providence’s Life at Night Economy

Life at Night Businesses + Operations

Photo: Salon, Isseniel Rodriquez

Executive Summary

This report shares the conditions and impacts of Providence’s “Life at Night” economy, the city’s supply of nightlife-oriented businesses that operate predominately outside the traditional 9 to 5. This study aims to help the City of Providence’s Department of Art, Culture and Tourism (ACT) and other local stakeholders better understand the dynamics and challenges that shape Providence’s Life at Night economy, impacts on local employment and fiscal revenue, and opportunities for the City to address related business, worker, and resident needs. JS&A outlines specific actions, targets, indicators, and recommendations to move the City of Providence forward with its work supporting Life at Night.

Providence’s Life at Night economy includes 632 businesses and contributes approximately 9,900 jobs, $351 million in annual labor income, and $990 million in annual revenue to the local economy. This economic activity accounts for 3.3% of the city’s overall economic output. In total, this activity also generates approximately $5.9 million in annual General Fund tax revenue to the City of Providence, through the Meals and Beverage Tax, as well as approximately $47 million of annual tax revenue for the State of Rhode Island.

Total Economic Impact of Providence’s Life at Night Economy

| Impact | Employment | Labor Income | Total Sales |

| Direct (Business Operations) | 7,903 | $226,925,589 | $619,936,385 |

| Indirect (Supply Chain) | 1,158 | $75,387,171 | $223,050,636 |

| Induced (Spending of Wages) | 852 | $48,774,880 | $147,268,058 |

| Total | 9,913 | $351,087,639 | $990,255,079 |

Key Opportunities to Enhance the Long-Term Vibrancy and Sustainability of Providence’s Life at Night Economy

- Advocate for more direct support and coordination for the Life at Night economy.

- Improve transportation to make it easier and safer to move around at night.

- Mitigate tension surrounding ownership and control of the City’s soundscape.

- Empower businesses and event organizers to enhance programming and events that elevate the cultural vibrancy of the city.

- Strengthen Providence’s reputation as an exciting cultural and entertainment hub for the region.

Introduction

About This Report

This study explores the scale and characteristics of late-night activity in the City of Providence, the economic impacts of such activity, and opportunities to better support and manage this piece of the local economy.

Defining Life at Night in Providence

“Life at Night” refers to the broad range of social, commercial, and municipal activity occurring after the standard working hours of 9am-5pm. This study primarily focuses on the conditions and impacts of the city’s “Life at Night” economy – the city’s nightlife-oriented businesses that predominantly operate in the evenings and late at night. However, the broader Life at Night ecosystem extends beyond just nightlife and includes city services, workers, and other industries, such as health care and education, that also operate late at night and in the early hours of the morning.

Study Participants

This analysis was commissioned by the City of Providence’s Department of Art, Culture and Tourism (ACT). This office is responsible for coordinating various cultural activities and serving as an intermediary between nightlife establishments, residents, and other City agencies. ACT supports a vision for Providence as a “global destination for arts, humanities, and design, where neighbors celebrate diverse cultural and artistic experiences, and where all residents and visitors feel that a relationship to arts practice, making, and culture is a part of their everyday lives.” For more information about ACT, visit artculturetourism.com.

ACT engaged Jon Stover & Associates (JS&A) to lead the creation of this study. JS&A is an Economic Development Consulting firm that specializes in economic and fiscal impact analysis, nightlife industry analysis, and economic development strategy. CIVIC, a Providence-based community engagement firm, was engaged to lead stakeholder engagement efforts for this study.

This study also acknowledges the efforts of business owners, community residents, and leadership from the Providence Police Department and City of Providence Board of Licenses for their participation in interviews and focus groups to inform study insights.

Study Purpose and Objectives

This study aims to help ACT and other local stakeholders better understand the dynamics and challenges within the city’s Life at Night economy, the sector’s impact on the broader local economy and City’s fiscal health, and opportunities for the City to address related business, worker, and resident needs. Specific recommendations are outlined for the City of Providence to move forward. This study also represents the implementation of a recommended activity (7.4.A.2) of the PVDx2031 Cultural Plan.

A New Focus on Nightlife

As people increasingly prioritize quality-of-life and cultural amenities when deciding where to live – a trend accelerated by the rise of remote work in the post-COVID economy, there has been an increased focus on the importance of nightlife as an economic, fiscal, and cultural driver. In response, cities have begun to seek new ways of understanding the characteristics and impacts of these nighttime activities.

This report and efforts in Providence do not only aid in local understanding and opportunity, but rather serve as a model for other similarly sized cities across the country.

Over the past decade, an increasing number of local municipalities have developed studies and plans specific to the nighttime sector. These studies typically leverage a mix of data and strategic stakeholder engagement to help inform local decision-making related to economic development, placemaking, safety, and infrastructure. Previous studies have largely focused on major metropolitan areas, making this study one of the few to assess nightlife conditions and contributions in a mid-sized market such as Providence.

Relevant Previous Studies

PVDx2031: A Cultural Plan for Cultural Shift

ACT led the creation of this plan, released in 2022, to strengthen arts, culture, and creativity within Providence. Developed over two years with extensive community input, the plan sets a course for a more culturally vibrant and connected Providence. The plan identified several strategic recommendations to better support creative professionals, foster economic growth in the creative sector, and enhance public well-being through cultural activities. One of these recommendations was the creation of a “study of life at night in order to identify and develop new operations in support of the City’s nightlife, entertainment industry and culinary scene.”

Defining “Life at Night”

This study intentionally defines the “Life at Night” economy more broadly than the traditional definition of nightlife primarily centered around late-night drinking and clubbing. The study acknowledges that nightlife is part of a larger ecosystem of activity and culture that occurs outside the traditional working hours of the day.

Linking to Best Practices

Best practices for supporting and strengthening the “Life at Night” economy are shared throughout the report.

Methodology

This study assesses the greater “Life at Night” ecosystem, defined as industries with significant operations after 5pm. The study’s impact analysis and assessment of industry conditions focuses more narrowly on the “Life at Night” economy, which is composed of industries typically associated with nightlife, including restaurants, bars, clubs, theaters, and other performance venues. JS&A conducted an economic and fiscal impact analysis to analyze the contribution of these establishments to the Providence economy. The analysis used leading data sources and data collected from local business operators.

Fiscal and Economic Impact Model. This analysis used an impact modeling software called IMPLAN, which leverages data and multipliers specific to Providence County to calculate the indirect and induced economic impacts and direct fiscal contribution of the Life at Night economy.

Contribution Analysis. A Contribution Analysis model in IMPLAN was used to determine how the Life at Night economy contributes to the greater local economy. This model accounts for industry-specific indirect business-to-business expenditures to limit overcounting contributions within the industry itself.

Assumptions and Limitations

This study takes a concrete definition of the industries included within the Life at Night economy. While this study acknowledges that there are supporting industries that play a role in nighttime activity in Providence, findings reflect only the direct industries defined as within the Life at Night economy.

Data Detail | Business Count & Employment Data

Following best practices, this study solely uses data from businesses with assigned North American Industry Classification System (NAICS) codes that are registered in the City of Providence. As a result, unregistered businesses and events are excluded from findings. This study used ESRI Business Analyst and DataAxle, a leading economic data provider, to pull 2023 business count and employment data for each of the three Life at Night industries. Data was pulled based on NAICS codes associated with the Life at Night economy (see p. 10 for additional detail on NAICS codes used for this study). Business count data may not directly align with City business licensing or registration data due to data discrepancies and varying business categorizations.

Importantly, business and employment data featured in this report is meant to serve as a snapshot of the overall scale of the Life at Night economy in Providence. Actual business count and employment data will change over time, as businesses continuously open and close throughout the city.

Data Sources

Third-Party Economic Data. The impact analysis is based on employment and business data from ESRI Business Analyst and DataAxle, a leading economic data provider. The analysis also uses employment estimates and local economic data from IMPLAN.

Previous Industry Studies. Recently conducted analyses and studies on local nightlife sectors in major cities were reviewed and assessed for best practices. Relevant Providence plans and policies, such as PVDx2031, were also reviewed.

Nightlife Industry Surveys. As part of this study, 69 digital surveys were completed by nightlife business owners and operators within the three industries. The survey captured how economic activity varies by industry, time of day, and day of the week, and quantified the needs and concerns of these industries. The Nightlife Industry Survey was administered electronically by ACT and other industry partners, and each respondent represented a separate establishment in the city.

Stakeholder Interviews & Focus Groups. This study gathered stakeholder input through community comprehensive plan meetings, one-on-one interviews, and focus group meetings. The purpose of these focus groups was to facilitate a thorough discussion of the unique needs and conditions of the Life at Night economy and the role varying agencies play in facilitating a vibrant, healthy nighttime ecosystem.

What is an Impact Study

An impact study assesses the effects of a particular industry, policy, project, or business on the economy of a specified geography. This study quantifies the economic and fiscal impacts attributable to Providence’s Life at Night industries using economic multipliers specific to Providence County. These multipliers measure how business activity within the Life at Night industries ripples throughout the local economy and supports additional job creation, wages, and revenue in other areas of the Providence economy. Impact studies are not predictive of future impact and are based on current economic and supply-chain behavior.

Life at Night Economy, Industry, Business Definitions

Life at Night Economy. This study defines the “Life at Night Economy” as the economic activity related to the operations, employment, and sales of three industries for which a large portion of activity occurs between 5pm and 5am: (a) restaurants, (b) bars and clubs, and (c) performance venues and theaters. This group of industries is also referred to as the “Life at Night sector” throughout the report, particularly when comparing it with other segments of the local economy, such as manufacturing or finance.

Life at Night Industries. This study assesses three industries most closely associated with nighttime activity: restaurants, bars and nightclubs, and theaters and performance venues. Importantly, there is significant overlap across these industries, with many businesses functioning as a hybrid of restaurant, bar, and/or performance venue. Collectively, they constitute what this study defines as the “Life at Night sector” or “Life at Night economy.”

Life at Night Business/Establishment. This term refers to an individual business within one of the Life at Night industries. This study uses assigned North American Industry Classification System (NAICS) codes to classify each business. The terms “business” and “establishment” are used interchangeably in this report.

NAICS Code Table

The North American Industry Classification System (NAICS) is the standard used by Federal agencies to classify individual business establishments. The U.S. Census Bureau assigns one NAICS code to each business based on its primary source of revenue. This study used ESRI Business Analyst and the NAICS codes below to pull business count and employment data.

| Industry | Business Type | NAICS Code |

| Restaurants | Restaurants and other Eating Places | 7225 |

| Bars/Clubs | Bars, Cocktail Lounges, Pubs, Night Clubs | 7224 |

| Performance Venues &

Theaters |

Theaters: Live | 71111007 |

| Theaters: Movie | 51213101 | |

| Concert Halls | 71131001 | |

| Comedy Clubs | 72241004 | |

| Stadiums and Arena | 71131003 |

General Glossary of Terms

Department of Art, Culture and Tourism (ACT)

City of Providence agency with the mission of developing a vibrant and creative city by integrating arts and culture into community life and showcasing Providence as an international cultural destination.

Board of Licenses (BOL)

City of Providence agency responsible for issuing and renewing liquor and live entertainment licenses to businesses in the city.

Contribution Analysis

The gross changes in a region’s existing economy supported by a given sector or industry.

Employment

The total number of full-time and part-time jobs.

Economic Impact

The attributable economic contribution to a local economy.

Direct Economic Impact

The businesses, revenue, jobs, wages, and other economic activity generated from the operations of a particular industry or industries.

Indirect Economic Impact

Indirect impact includes the supply chain of goods and services from other industries that enable activity in a given industry.

Induced Economic Impact

Induced effects are the results (i.e., spending) of increased personal income caused by the direct and indirect effects.

Fiscal Impact

The amount of tax revenue to Providence and the State of Rhode Island generated from an economic activity, including sales tax, alcohol tax, income tax, and the issuance of licenses and permits. This study does not include property tax in its fiscal impact.

IMPLAN

A leading economic modeling software used to calculate the economic impact of nightlife industries in the local economy. The analysis uses County-specific economic multipliers.

Rhode Island Public Transit Authority (RIPTA)

State public transportation agency that operates all public buses and other public transit options within Providence.

Providence Police Department (PPD)

The primary law enforcement agency for the City of Providence, responsible for handling most public safety concerns, sound complaints, and security for large festivals and other events.

Providence Warwick Convention & Visitors Bureau (PWCVD)

The tourism entity dedicated to promoting Providence, Warwick, and the surrounding region as attractive destinations for visitors, conventions, and events.

Life at Night in Providence

The Creative Capital doesn’t stop at 5pm.

Late night activity adds to Providence’s cultural identity and economic opportunity.

What makes Providence’s Life at Night unique?

Providence’s nightlife is as distinct and diverse as the many people and cultures that define the city. The mix of Life at Night establishments showcases Providence’s more accessible entrepreneurial environment compared with New England’s other major cities. The city’s large-scale festivals attract thousands of visitors and countless local productions and events that bring together art, music, and culture throughout the city all year long.

- More Nightlife Establishments Per Person Than New York City

- A Higher Share of Students Than Philadelphia

- Commercial Rent Half as Expensive as Boston

- A Population as International as Los Angeles

Notes and Sources: Providence has 632 nightlife establishments compared with a population of 190,792 (301 people per venue); New York has 23,900 nightlife establishments and a population of 8.6 million (360 people per venue) (US Census, 2022-2023). Providence’s average commercial retail rent rate of $23/SF is less than half of Boston’s average retail rent of $51/SF (CoStar, Q3 2024). Approximately 25,733 students are enrolled at a college or university in Providence, reflecting 14% of the population. Philadelphia’s 128,994 enrolled students constitute only 8% of Philadelphia’s population (US Census, 2022-2023). The range of cultural influences on Providence’s nightlife is nearly unrivaled. A total of 32% of Providence’s residents are foreign born, which is more than Boston (28%) and almost as much as San Francisco (34%) and Los Angeles (36%). Furthermore, 43% of Providence’s population is Hispanic or Latino—on par with Phoenix (43%) (US Census, 2018-2022).

An established citywide “Creative Capital” brand

Providence has a long history and status as a highly creative city, supported by the Rhode Island School of Design, its major arts festivals, and an economically strong creative sector. The city recently created a new cultural plan, PVDx2031, to strategically support further growth of its cultural assets while building on prior efforts to support arts and creativity.

18+ Nightclubs for an age-inclusive nightlife scene

Providence is well-known regionally for its supply of night clubs that welcome patrons 18 years old or older. This base of 18+ nightclubs has developed due to the nearly 26,000 college students who call Providence home. This younger population helps support a steady base of both patrons and staff for Providence’s Life at Night economy.

A diverse mix of business owners and residents

Cultural diversity is a core part of Providence’s identity. The city has one of the largest Hispanic populations of any city in the northeastern United States by share (46%), and 32% of residents are foreign-born, compared with the national average of 14%. This diversity is reflected in the city’s businesses, with numerous Life at Night businesses that feature the food, music, dance, and culture of the Dominican Republic, Guatemala, Portugal, and Colombia, among others.

Signature festivals and events at night

Providence is home to several major festivals and numerous small-to-mid scale events that enliven the city’s streets and public spaces, while attracting visitors from around the region. These include PVDFest, the city’s signature outdoor arts festival; WaterFire, the award-winning fire sculpture installation on Downtown’s rivers; and the popular summer festival series Day Trill, as well as RI PRIDE, the Dominican Festival, Cape Verdean Independence Day Festival, Day of Portugal celebration, Puerto Rican Bay Fest, and more.

Unrivaled independent venues

Providence offers an independent venue scene unmatched by most cities of comparable size. Without one commercial entity owning and operating the majority of venues, the community benefits from more artist-driven entertainment offerings and cultural and musical expression. This fact alone is a major draw for Providence, coupled with its close proximity to Newport, home of two of the nation’s preeminent music festivals; the Newport Folk Festival and Newport Jazz Festival, with a cumulative estimated economic spending contribution of over $5,000,000 for the region. Providence’s independent venue scene enables these festival attendees to experience similar shows throughout the year.

Clusters of Nightlife activity spread across the city

Providence features several distinct clusters of late-night activity that provide Life at Night patrons with a mosaic of atmospheres to choose from, ranging from the historic and bustling Atwells Avenue, the more student-centric College Hill on the city’s East Side, the growing cluster of primarily Latino-owned establishments along South Broad Street, and the emerging supply of cultural and mixed-use spaces in the formerly industrial area of Olneyville.

Providence’s nightlife plays a key role in making the Creative Capital a fun, dynamic, and culturally rich place to live, work, and play. From the restaurant-lined DiPasquale Square in Federal Hill to downtown speakeasies, East Side dive bars, and South Side dance clubs, the city’s nightlife offers something for everyone.

Life at Night Economy Ecosystem

City life encompasses a wide range of commercial, social, and creative activities taking place throughout all times of the day. In many ways, the activity that takes place during traditional weekday working hours is supported by work that takes place during the early mornings, late nights and on weekends.

Early Morning

Before most of Providence wakes up, many residents are already working, on their way to an early-morning shift, or returning home from a late-night shift. These workers come from a wide range of industries, from health care workers to construction workers, security guards, bus drivers, commercial cleaning workers, and more.

Morning

By 8am, Providence is ramping up for a full day of activity, with most residents on their way to work, students just starting school, chefs prepping ingredients for the day, and many food service workers preparing for the upcoming brunch/lunch rush.

Afternoon

The city is in full swing by the afternoon – downtown office workers are grabbing lunch, college students are traversing their campuses, bars and clubs are preparing to open, and performing arts professionals are rehearsing for evening shows.

Evening

As many in Providence end their workday, many Life at Night businesses are entering their peak hours of customer traffic. Dinner service is underway at restaurants, bars are opening their doors, and sporting events, fitness classes, and performing arts venues are filling up.

Late Night

By 10pm to midnight, most restaurants, theaters, and fitness/wellness businesses have closed to the public, with staff working on closing shifts and heading back home. Meanwhile, many music venues, bars, clubs, and lounges are entering their prime hours – attracting people looking for a post-dinner drink, dance, or show.

Early Morning

As the morning approaches, many Life at Night employees, particularly at clubs and performance venues, are still working on closing shifts. Meanwhile, numerous other workers in other 24/7 industries head out for early-morning shifts, getting ready to support the rest of the city as another full day

begins.

About the Life at Night Economy

Providence’s Life at Night economy is composed of restaurants and bars, nightclubs, concert venues, and theaters. These industries play leading roles in the culture and economic base of the city’s nighttime ecosystem.

These industries attract people to go out at night, socialize, and engage with the city – driving consumer spending and employment at night.

From recreational leagues to health and wellness activities to sporting and signature events, supporting industries help draw a more robust customer base to the primary industries. These supporting industries typically feature less consumer spending and generate less revenue than late-night activities and may be free to attendees.

Additional industries vital to Providence also function outside of the traditional daytime economy, such as healthcare, transportation, and manufacturing. However, while these industries play an overlapping role with Providence’s Life at Night, they are commonly referred to in isolation from nightlife and feature distinct operational characteristics.

Primary Industries in the Life at Night Economy

- Performing Arts and Theater

- Concert Venues and Shows

- Restaurants

- Bars and Nightclubs

Life at Night Supporting Activities

- Shopping

- Wellness

- Sporting events

- Signature events

- Recreation

Additional Late-Night Industries

- Public Safety, Public Works, and City Workers

- Logistics and Transportation

- Manufacturing and Industrial Uses

- Higher Education Campuses

- Gig Economy

- Healthcare Industry

Photo: DAYTRILL, Rafael Medina

Providence’s Life at Night Economy

Providence’s Life at Night industries play a significant role in the greater economic vitality of the city.

Providence’s Life At Night economy includes a robust cohort of businesses and a strong employment base that contributes to the economic health of the city.

- 630+ Life at Night Businesses across the city

- 7,900+ jobs in the Life at Night Economy

- 30% of Rhode Island’s Bars and Clubs are in Providence

- Nearly $620 Million of Annual Collective Revenue in the Life at Night Economy

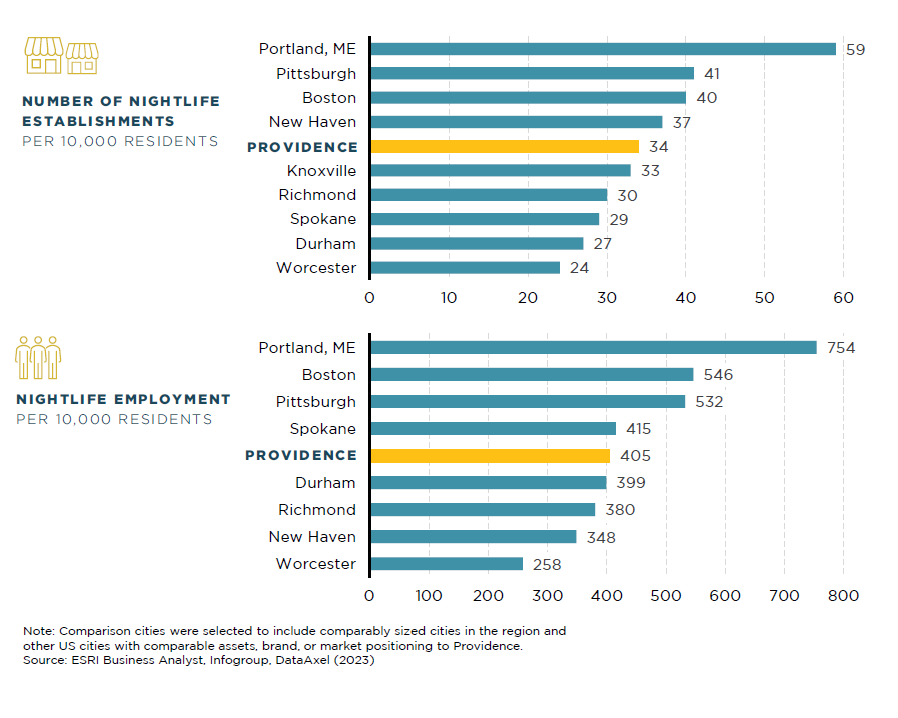

Top: Number of Nightlife Establishments per 10,000 residents; Bottom: Nightlife Employment per 10,000 residents. Note: Comparison cities were selected to include comparably sized cities in the region other US cities with comparable assets, brand, or market positioning to Providence. Source: ESRI Business Analyst, Infogroup. DataAxel (2023)

Nationwide Spotlight: How Providence’s Life at Night Economy compares with other cities relative to its population

The overall size of Providence’s Life at Night economy is on par with comparable cities with similar size or market positioning.

These mid-sized cities are not what normally come to mind when thinking about major nightlife destinations. Yet, these cities each feature historic cultural assets, and large student and non-student customer bases.

Providence’s share of Rhode Island’s total supply of Life at Night establishments

Providence’s Life at Night economy not only serves local residents but functions as a node of nightlife activity for the broader State of Rhode Island.

The city features a higher share of Rhode Island’s greater Life at Night economy. While Providence has 17% of Rhode Island’s residential population, the city features almost a third (30%) of the state’s bars and clubs and more than a quarter (26%) of its performance venues. As such, residents from across the state and region come to Providence to enjoy the density and diversity of nightlife offerings.

Photo: Courtland Club, Isseniel Rodriquez

The Economic Impact of Providence’s Life at Night Economy

Providence’s Life at Night economy not only adds to the vibrancy and culture of the city, but significantly contributes to the local economy.

Providence’s nightlife economy includes 632 businesses and contributes approximately 9,900 jobs, $352 million in annual labor income, and $990 million in annual revenue to the local economy. This economic activity accounts for 3.3% of the city’s overall economic output. This impact extends beyond the primary nightlife industries, supporting employment and revenue in a wide range of industries that provide products and services to nightlife businesses and benefit from the spending of nightlife employee wages.

Providence’s Life at Night Economy contributes $990 million annually to the local economy and supports over 9,900 jobs.

The City’s 632 Life at Night businesses generate nearly $620 million in collective annual revenure that sparks a total economic impact of $990 million each year.

| Impact | Employment | Labor Income | Total Sales |

| Direct Impact | 7,903 | $226,925,589 | $619,936,385 |

| Indirect Impact | 1,158 | $75,387,171 | $223,050,636 |

| Induced Impact | 852 | $48,774,880 | $147,268,058 |

| Total Economic Impact | 9,913 Jobs | $351,087,639 | $990,255,079 |

The “Total Sales” column reflects “Industry Output,” which is the value of production by the nightlife economy in a calendar year. Specifically, this figure describes annual revenues plus net inventory change. Labor income do not add up to sum due to rounding. Source: IMPLAN based on Nightlife Industry Data, ESRI (2023)

How Nightlife Spending Impacts Providence’s Economy

$619,936,385

Direct Impact

Industry Operations

When a patron spends money at a nightlife establishment, this revenue directly supports business operations, supports the wages of its employees, and generates city tax revenues.

$223,050,636

Indirect Impact

Business-to-Business Expenses

Dollars spent at a nightlife establishment not only impact the business where the transaction takes place, but also impact additional industries that rely on purchases made by nightlife establishments.

$147,268,058

Induced Impact

Spending of Wages

Household spending of income earned by nightlife industry workers supports additional business activity and job creation.

$990,255,079

Total Economic Impact

The collective annual direct, indirect, and induced effects of the Life at Night economy.

Spotlight Insight: Impact on Resident Attraction and Retention

A vibrant nightlife sector plays a key role in helping attract and retain residents.

US adults, particularly young professionals, increasingly prioritize quality-of-life and cultural amenities when deciding where to live. This supplemental impact, while not quantified in this study, is another key piece of nightlife’s comprehensive impact on Providence’s economy.

Fiscal Impact

City of Providence Fiscal Impact

Providence’s Life at Night economy supports the city’s fiscal health directly through Meals and Beverage Tax revenue, as well as secondary benefits to its long-term fiscal base.

A significant share of sales in Providence’s Life at Night establishments are subject to the Local Meals and Beverage Tax, in which all food and drink purchases are levied with a 1% tax (in addition to the statewide 7% sales tax) that goes toward the City of Providence General Fund. In total, these transactions generate approximately $5.9 million in annual General Fund tax revenue, accounting for 1% of the City’s total General Fund revenue.

Note: Analysis uses FY2023 tax revenue and total household figures from ESRI Community Analyst. Source: Rhode Island Division of Taxation, IMPLAN, based on Nightlife Industry Data.

State of Rhode Island Fiscal Impact

The city’s Life at Night economy generates approximately $47 million of annual tax revenue for the State of Rhode Island.

Sales tax revenue from Providence’s Life at Night economy makes a significant fiscal impact on the State, generating approximately $41.6 million in revenue each year. This accounts for 2.6% of the State of Rhode Island’s total sales tax revenue.1 In addition to sales tax revenue, Life at Night sales also generate $3.1 million in personal income tax revenue and $1.8 million in other statewide tax revenue from corporate profit taxes, property taxes, and other miscellaneous taxes and fees levied by the State of Rhode Island.

Estimated share of annual sales tax revenue uses the FY2023 total Sales and Use tax revenue total of $1,579,000,000.

| Tax | RI State Annual Tax Revenue | City of Providence Fire/School District Annual Tax Revenue | City of Providence General Fund Annual Tax Revenue | Total |

| Meals & Beverage Tax | $41,615,132 | $0 | $5,989,903 | $47,605,035 |

| Property Tax | $30,639 | $752,951 | $26,631,634 | $27,415,225 |

| Personal Income Tax | $3,128,728 | >$0 | $0 | $3,128,728 |

| Corporate Profits Tax | $700,595 | >$0 | $0 | $700,595 |

| Misc. Taxes & Fees | $1,781,239 | $55,332 | $620,922 | $2,457,493 |

| Total | $47,256,333 | $808,283 | $33,242,460 | $81,307,076 |

Note: The chart above reflects only the direct fiscal impact of revenue at nightlife establishments and does not include indirect and induced fiscal impact figures. Miscellaneous taxes and fees include commercial motor vehicle licenses, personal motor vehicle licenses, severance taxes, special assessments, and other local taxes on production and imports. Sum of figures may not equal total figures due to rounding. Estimated sales tax revenue based on IMPLAN estimate of performance venues’ sales tax revenue collected at performance venues and the collected Meals and Beverage Tax from the Rhode Island Division of Taxation (2023).

Commercial Property Tax Impact

Providence’s Life at Night economy supports approximately $26.6 million in annual property taxes.

The demand from commercial tenants in the Life at Night economy increases the overall value of commercial properties in Providence, thereby supporting a share of the city’s property tax revenue. While this type of revenue is not directly generated from the nightlife business transactions, it is an important piece of the overall fiscal impact of the nightlife economy.

Providence’s Life at Night Businesses & Operations

The dynamics of operating a business and working during nighttime hours differ from the typical 9-5 model.

Providence’s Life at Night Industry Operations

Life at Night industry businesses make most of their revenue within a relatively small block of time each week, heavily relying on strong customer traffic after 5pm and on Friday and Saturday nights to keep operations afloat.

Most nightlife establishments in Providence earn nearly 80% of their revenue after 5pm. Restaurants in Providence make nearly two-thirds of their revenue during the weekend. Bars and clubs are even more dependent on strong weekend sales, earning approximately 75% of their weekly sales during the weekend. The sector’s reliance on strong late-night sales underscores the importance of enhancing late-night safety and transportation conditions, which will allow more customers to comfortably go to or stay at businesses at later hours. Daytime sales are also a significant revenue generator for many businesses, with nearly one-quarter of overall sales occurring before 5pm.

Providence’s Life at Night economy is composed almost entirely of small businesses. The average bar and nightclub in Providence reports approximately $772,000 in annual revenue, while the average restaurant in the city reports $974,000. Unsurprisingly, performance venues and theaters average just under $2.4 million per year.(1)

Industry Insight: Bar and Nightclub Operations

Late-night customer traffic is particularly essential to financial viability of bars and clubs.

Nearly 20% more revenue is generated after 9pm compared with the general nightlife economy. For nightclubs, late nights are even more essential for operations, with local club owners reporting that sales are typically highest from 11:30pm to 1am.

“We have 9 hours per week essentially to make all our revenue for the year.”

– Downtown nightclub owner, on the importance of weekend sales between 10:30pm and 2am.

The city’s Life at Night workforce includes over 7,900 jobs directly within the sector and 64% of these employees work part-time.

27% of employees work between 5:00 AM and 5:00 PM; 42% between 5:00 PM and 9:00 PM; and 31% between 9:00 PM and 5:00 AM

Source: Nightlife Establishment Surveys (2023)

Life at Night Economy – Employment

Jobs within the city’s Life at Night economy generate over $351 million of salaries and wages annually.

Providence’s Life at Night economy employment is primarily concentrated within the restaurant industry, representing nearly 7,050 jobs. In addition, bars, nightclubs, performance venues, and theaters support an additional 855 jobs in Providence. When accounting for the indirect and induced impacts of the sector, over 2,000 more jobs are supported by the city’s Life at Night economy.

Many of the jobs within the Life at Night economy are second jobs, and its employment is often underreported by data sources. Relatedly, because of the part-time nature of this sector, most of these jobs do not offer health insurance, a notable challenge for many employees.

Employment & Wages Supported by Providence’s Life at Night Economy

| Business Type | Total Jobs | Annual Salaries & Wages | Average Annual Salaries & Wages |

| Restaurant | 7,048 | $201,289,547 | $28,560 |

| Bar/Nightclub | 575 | $18,728,345 | $32,571 |

| Performance Venue/Theaters | 280 | $6,907,697 | $24,670 |

| Other Businesses Supported by Nightlife | 2,010 | $124,162,050 | $61,772 |

| Total | 9,913 | $351,087,639 | $35,417 |

Note: Employment figures include full-time and part-time jobs. Employment figures of “Other Businesses Supported by Nightlife” reflects the indirect and induced impact on local employment as a result of Providence’s nightlife economy as calculated by IMPLAN using Providence County-multipliers. Source: IMPLAN, ESRI Business Analyst (2023)

Industry Insights – Local Workforce Development

The nightlife industry plays a key role in the development of the local workforce, providing opportunities for career development, creative collaboration, and helping workers meet financial and lifestyle needs.

Career Development and Transferable Skills

The nightlife sector offers one of the most accessible starting points for the local workforce, with a large supply of entry-level jobs accessible to people who speak different languages, have differing educational backgrounds, and who have diverse skill sets and experiences. Whether they work as a server, barback, cook, or hostess, the nightlife industry plays a key role in the education and career paths of countless Providence residents. The industry provides opportunities to develop hard skills, such as cooking, bartending, managing payroll or inventory, and a wide range of soft skills. These soft skills, such as customer service, teamwork, problem-solving, team management, multitasking, and performing in high-pressure environments, are highly transferable to a wide range of careers. In addition, as technology and automation continue to advance, such soft skills are becoming increasingly valued in the greater workforce, making the nightlife sector an even stronger engine for local workforce development.

There are also a wide range of opportunities to climb the ladder within the nightlife industry. Waitresses and bartenders can progress to more senior roles within the restaurant industry, such as general manager or beverage coordinator. Similarly, stagehands, sound and lighting engineers, and support staff at music venues and theaters can progress to becoming lead technicians, recording engineers, talent buyers, and stage managers.

Entrepreneurship

Most nightlife business owners start as entry-level employees in the nightlife industry. Eighty percent of restaurant owners began in an entry-level position in the culinary world as a line cook, hostess, or waiter. These individuals gain the experience necessary to go out on their own, pursue their creative vision, and add dynamism to the local nightlife ecosystem.

Cross-Pollination with other Creative Industries

The nightlife industry and creative industries tend to cross-pollinate. Late-night venues are essential gathering and presentation spaces for performing and visual arts professionals, who form the backbone of the Creative Capital.

Flexible Lifestyle

The nightlife industry is uniquely suited to allow employees to pursue other passions, careers, and priorities while making an income. Because the hours worked in the nightlife industry are generally the “off-hours” for other sectors, some nightlife employees work other jobs, go to school, nurture other interests, or take care of other responsibilities such as caregiving.

Photo: Daytrill, Rafael Medina

Industry Insights – Talent Attraction and Retention

A strong nightlife industry helps attract and retain residents by providing job opportunities and enhancing citywide culture and quality of life.

In a post-pandemic labor market characterized by remote and hybrid work opportunities, employees have increased flexibility about where they live and work. This has limited many urban municipalities’ ability to retain and attract residents who are now less tied to the location of their employer. This shift has accelerated the trend of individuals prioritizing quality of life and cultural amenities when deciding where to live and work. The quality of a place’s nightlife and cultural ecosystem are often critical pieces of these decisions made, particularly among college-educated young professionals with expendable income. This demographic often looks for opportunities in cities with active, culturally diverse nightlife scenes where they can engage in cultural activities and easily meet people and socialize. As such, a strong nightlife industry often plays a key role in the attraction and retention of a strong local workforce and residential base, resulting in long-term economic and fiscal benefits to municipalities.

In addition, many nightlife establishments play a critical role in attracting and nurturing creative and artistic talent. Research indicates that artistic and cultural producers are densely agglomerated, and depend on unique kinds of social interaction, such as that made possible in clubs and bars, to thrive and produce. As such, a healthy supply of clubs, theaters, performance venues, art galleries, and other creative spaces are key drivers toward helping Providence build on its stature as a “Creative Capital” and grow its creative community.

Industry Insights – The Challenge of Transportation

Limited late-night public transit options impact the nightlife workforce and other late-night employees.

Limited late-night public transportation and employee parking were cited as significant challenges for nightlife businesses in retaining and hiring employees, as limited late-night bus routes make it difficult, and sometimes unsafe, for employees to get home after a late-night shift. Limited parking options near businesses also result in employees needing to park far away from their places of employment, creating safety concerns about walking back to cars after a late-night shift.

“The Buses don’t run often enough, so I have stopped hiring people who have to take the bus to or from work.”

– Ward 13 Business Owner

RIPTA Bus Service Declines After 9:30PM

Most Rhode Island Public Transit Authority (RIPTA) buses finish service between 5:30pm and 9:30pm. Out of 68 routes, 22 have service after 10 pm, and five after midnight. Local routes tend to have service every 45 minutes to an hour. High-frequency bus routes run every about every 20 minutes, though frequency tends to decline after 9:30pm.

Late-Night Transportation and Safety Challenges Extend Beyond the Nightlife Workforce

Life at Night establishments are not the only businesses open late in Providence. Workers in a wide range of industries are also affected by late-night transportation and safety challenges. For example, the Rhode Island Hospital complex, one of the city’s largest clusters of late-night employment outside the Life at Night economy, has notably limited late-night transit access. More frequent bus service and enhanced safety precautions can play a key role in not only supporting the local nightlife workforce but also for improving the long-term health of the greater late-night workforce.

Success Stories: Expanding Late Night Transportation Options

Cities across the US are taking steps to expand late-night transportation options.

In Pinellas County, Florida, the Transportation Disadvantaged Late Shift Program partners with Uber and local taxi companies to provide free rides from 10pm to 6am, when bus service is not available. The program is designed to help workers access jobs that require late-night transportation and households with incomes up to 150% of the poverty level. In 2018, Massachusetts Bay Transportation Authority ran a pilot program to extend bus service in the early morning (before 5am) and late at night (after 10pm). After one year, 140 of these trips were made permanent.

Photo: Calle Caliente Latin Night Troop, Rafael Medina

Providence’s Life at Night Industry Needs & Strategies

A range of opportunities exist to continue tackling late-night business challenges and bolster Providence as an exceptional place to live, work, socialize, and do business at night.

Understanding Life at Night Industry Challenges

Despite a post-pandemic uptick in business, Providence’s Life at Night businesses face ongoing economic and operational hurdles.

In total, nearly half of all nightlife businesses report that customer traffic levels are below the typical volume experienced before the onset of the COVID-19 pandemic in March 2020. This trend is relatively similar for restaurants and bars, with 53% of restaurants and 47% of bars reporting lower levels of customer traffic. Several businesses cited a spike in alcohol sales in mid-2021, as regulations began to be lifted and customers excitedly began to revisit businesses. However, businesses reported a subsequent decline in customer traffic beginning in 2022, as inflation decreased levels of disposable income and subsequent consumer spending.

However, despite the struggles to regain pre-2020 customer traffic, business owners are optimistic about future growth. Nearly half of restaurant and bar/club owners reported that they expect their business to expand over the next two years. Fewer than 15% expected their business to close or contract. Restaurants were slightly more optimistic than bar and club owners. This difference likely reflects the impact of some of the bar and club-specific challenges, including rising security costs and customer perceptions of crime and safety.

Insights into Operational Challenges

Safety, transportation, and rising costs are the top operational challenges faced by nightlife businesses.

Businesses are feeling the effects of high inflation over the past two years and have noted that consumer spending has not kept up with the rising prices of labor and goods. Limited late-night transportation, for customers and particularly for employees, was also frequently cited as a major challenge. These problems are exacerbated by the more fundamental challenge of customer traffic levels still lagging behind pre-pandemic levels, putting extra pressure on establishments to provide quality service with declining revenue and increased costs.

Inflation and Rising Costs

The rising costs of labor and supplies was the most cited major challenge for nightlife establishments. While this challenge is not unique to Providence or the nightlife industry, low profit margins at nightlife establishments make the industry particularly vulnerable to high inflation.

Access to Capital

One in four surveyed nightlife establishments cited access to capital as a major operational challenge. This challenge is even greater for minority and women-owned businesses. Fifty-six percent of Black-owned businesses cited access to capital as a major challenge, along with 42% of women-owned businesses and 38% of LGBTQ+-owned businesses. Access to capital was comparatively less of a challenge for Latino-owned businesses, with 17% citing it as a major challenge.

Spotlight: Industry Conditions

Restaurants and bars have some of the tightest profit margins of any business type.

Most restaurants and bars operate with approximately 5-7% profit margins. Performance venues are also notoriously challenging to operate at a consistent profit, with many venues opting to operate as 501c3 nonprofits to qualify for grants and other public funding to help close gaps in operating budgets. These tight margins make it particularly difficult to make ends meet when faced with a sudden increase in labor and supply costs.

“Further educate merchants about the laws that apply to online application bars and processes; which many merchants pay up to $3,000 as a fee to lawyers or offices to fill out applications. (Translated)”

– Providence Business Owner

Downtown Activity and Safety

Many businesses located Downtown cited a lack of consistent foot traffic before 5pm and after 9pm in the area. In addition, many cited a lack of adequate lighting and limited police presence as factors contributing to employee and customer hesitation about walking around Downtown at night. Business owners believe this hesitation ultimately leads to reduced sales.

Private Security Costs

Bar owners, particularly nightclub owners, cited the rising costs of private security as a major operational challenge. According to several business owners, limited police presence has resulted in the need for clubs to hire additional private security guards in recent years to strengthen real and perceived customer safety.

Employee Retention and Attraction

Like many small businesses over the past several years, nightlife businesses report significant struggles to attract and retain employees – a reflection of a nationwide labor shortage and the relatively high staff turnover rate.

Labor shortage and high turnover limit the efficiency of operations and have forced many businesses to adjust hours and/or limit the number of special events they offer. Limited late-night transportation options make it difficult for businesses to retain and attract employees, many of whom struggle to find ways to safely and economically get to and from work.

Source: Nightlife Establishment Surveys (2023)

Business Operational Challenges

What are your biggest operational challenges?

Surveyed Life at Night businesses reported the following operational challenges that they currently face within their business.

- Inflation and Rising Costs – 58%

- Employee Parking – 47%

- Attracting, Hiring, and Retaining Employees – 38%

- Access to Capital – 27%

- Rent Affordability – 25%

- Customer Acquisition and Retainment – 25%

- Navigating Regulatory Processes – 24%

- Employee Transportation To and From Work – 18%

- Waste Management – 16%

- Rodents – 15%

- Safety Issues – 13%

- Conflicts with Residential Neighbors – 9%

- Navigating Liquor Licensing Process – 7%

- Code Enforcement – 7%

- Conflicts with Business/Office Neighbors – 4%

“Facilitating a safe space for patrons to go as a nightlife business is usually our number one priority.”

– Ward 1 Business Owner

Photo: Crib, Isseniel-Rodriquez

Spotlight Insight: Mitigating Tension Around Sound in the Public Realm

Music and crowds are fundamental commercial and cultural elements of most bars, clubs, performance venues, and event spaces. As such, all urban nightlife scenes deal with the inherent challenges that arise when entertainment and commercial uses are located near residential areas. These challenges are exacerbated in older cities such as Providence, which features a particularly high degree of mixed-use neighborhoods, as most major commercial corridors in the city are directly adjacent to residential areas. As such, it is important for Providence to ensure that nightlife uses do not cause excessive nuisance for nearby residents.

Several Providence residents, many of whom are concentrated in the Lower South Providence, Elmwood, and Washington Park neighborhoods, have cited a handful of Providence bars and clubs that violate city ordinances on appropriate noise levels. Specific related issues cited include the following:

- Rhode Island Department of Business Regulation overturning City of Providence Board of Licenses decisions to revoke or suspend liquor licenses.

- Limited online access and participation opportunities for residents to participate in Board of Licenses meetings.

- Limited staff capacity of the Office of the Board of Licenses.

- Limited tracking of Providence Police Department noise-related visits and resulting lack of data and evidence that can be brought to bear on future licensing decisions.

- Lack of effectiveness of fines for deterring noise and safety violations.

A lack of adequate noise ordinance enforcement can lead to negative outcomes for both residents and businesses. Excessive noise can disrupt nearby residents’ sleep and quality of life, result in lower nearby property values, and strain relationships between businesses and their local customer base.

While limited data makes it difficult to quantify the actual deterrent effects of existing enforcement mechanisms or the precise degree to which existing noise ordinances are being enforced, the land-use pattern in Providence makes enforcing existing noise ordinances particularly important. The proximity of venues and residents also magnifies the importance of ensuring residents and other stakeholders can easily utilize the existing PVD311 system to document violations.

Best Practice Spotlight: Success Stories

While neighborhood conflicts around sound are incredibly common across US cities, particularly in older, mixed-use neighborhoods, there are a relatively limited number of public programs designed to directly address challenges such as debates over the acoustics of public space and neighborhood conflict. Reducing the number of complaints and conflicts may involve a balance of regulation, mediation, and technology.

Mend Program – New York, New York

New York City’s Mediating Establishment and Neighborhood Disputes (MEND) program provides free mediation and conflict resolution services to city residents and businesses to address neighborhood disputes. MEND helps establish direct lines of communication, so that residents may build respectful, ongoing relationships with nearby businesses while ensuring that small businesses thrive. Common issues also include negotiation between commercial tenants and landlords, and neighboring businesses. MEND was launched in summer 2020 as a collaboration between NYC’s Office of Nightlife and the Center for Creative Conflict Resolution (CCCR). NYC’s Office of Nightlife also provides resources and tools for businesses interested in reducing their negative impacts on neighborhood quality of life.

Noise Mitigation Grants Program – San Antonio, Texas

The City of San Antonio’s Noise Mitigation Grants Program funds up to 75% of qualifying costs for local business owners to reduce the amount of sound bleeding from their venues into public spaces. This grant program can cover consulting fees, the purchase of equipment, installation, and renovation. To be eligible, businesses must be zoned for commercial use, have less than $9M in gross revenue, and not have any outstanding code violations. In 2023, the City of San Antonio disbursed over $122,000 to 21 businesses, with the average grant totaling almost $6,500.

Moving Forward

Everyone plays a role in helping to grow and support Providence’s Life at Night economy.

Patrons and Customers

Customers are the backbone of Providence’s Life at Night economy. The city’s customer base is composed of a rich mix of long-time residents, college students, young professionals, office workers, and out-of-town visitors, including many tourists visiting Newport who come to Providence to dine and spend the night.

Businesses and Employees

Most Life at Night establishments in Providence are owned by local entrepreneurs, navigating the daily tribulations and inherent risk of operating in a highly competitive market with tight profit margins. These businesses are propelled by a diverse workforce, ranging from highly experienced, full-time staff to part-time workers, many of whom are balancing multiple jobs or other educational and creative pursuits.

City Agencies

Sustaining a vibrant, safe, and resilient nighttime economy requires numerous city agencies playing their role and working together. From ensuring safe conditions for patrons and employees, developing clear licensing and permitting processes, and strategically marketing the city’s brand, the City of Providence is positioned to continue leading the charge in ensuring Providence is a quality place for late-night economic activity.

Regional and State Partners

State agencies play a key role in supporting Providence’s Life at Night economy, most notably through the enhancement of late-night RIPTA service, regional marketing support from Rhode Island Commerce’s Visit Rhode Island campaign, and continued liquor and business licensing coordination with the Rhode Island Department of Business Regulation.

Strategic Opportunities for the City of Providence

There are several key opportunities for the City of Providence, in partnership with the State of Rhode Island and other local partners, to help enhance the long-term vibrancy and sustainability of Providence’s Life at Night economy, support late-night workers, and ensure its position as a positive contributor to residents’ quality of life.

Advocate for more direct support and coordination for the local “Life at Night” economy

Create a new position within the Department of Art, Culture and Tourism to directly coordinate with City agencies and nightlife businesses to support the economic resiliency, safety, and quality of the city’s Life at Night economy.

Make it easier and safer to move around at night

Expand late-night transportation options to better support Life at Night patrons and workers, while simultaneously enhancing late-night employee transportation in other industries.

Mitigate tension around ownership and control of acoustic space

Continue enforcing existing sound ordinances, prioritize enforcement for businesses repeatedly cited for noise violations, and assess the viability of new programs to mediate sound-related issues between residents and businesses.

Empower businesses and event organizers to develop unique programming that elevates the cultural vibrancy of the city

Build off momentum from the City Services review process to help more small businesses and event organizers with licensing and permitting.

Strengthen Providence’s status as an exciting cultural and entertainment hub for the region

Draw additional regional visitors to the city by celebrating and marketing the diversity, creativity, and independent businesses that comprise Providence’s Life at Night landscape.

Recommended Strategic Action Steps

The following Action Steps are recommended to the City of Providence’s Department of Art, Culture and Tourism for continued improvement to the city’s Life at Night economy.

Opportunity: Advocate for more direct support and coordination for the local Life at Night economy

Designate a new position (“Nighttime Manager”) within ACT, or across ACT, BOL, and Office of Economic Development, that can serve as the lead liaison between nightlife businesses, employees, residents, and City agencies.

Re-launch a 2024/2025 edition of the 2017 “Best Practices: Providence Nightlife” document. Consider reformatting the document to be more visual and reader-friendly. Update information for current regulations, processes, and best practices. Provide a Spanish-language version of the document. Distribute the updated document to local business associations and other relevant organizations and share the document through ACT channels.

Explore stakeholder interest and feasibility regarding creation of “Life at Night” districts in areas with a high concentrations of nightlife activity. District designation may provide qualified businesses with streamlined liquor licensing and special event permitting processes, extended operating hours, allowances to offer happy hour specials, and/or prioritized access to sound mitigation and mediation services.

Opportunity: Make it easier and safer to move around at night

Leverage the role of a “Nighttime Manager” (see above) to organize and lead a task force of stakeholders affected by late-night transportation issues, including leadership from Rhode Island Hospital Center, local universities, nightlife employees, nightlife business owners, and RIPTA, to determine specific late-night transportation needs and opportunities to leverage university-operated transportation services to serve nightlife workers and patrons.

Improve lighting in Downtown to enhance the real and perceived safety of nightlife customers and employees.

Opportunity: Mitigate tension around ownership and control of acoustic space

Leverage multi-departmental response mechanisms already in place to prioritize noise ordinance enforcement for businesses repeatedly cited for noise violations.

Continue sending PPD and BOL staff to the Community Noise Enforcement Certification Course at Rutgers University Noise Technical Assistance Center or another certified entity. Change language around “noise” in City ordinances to “sound” when referring to sounds created by music or people at nearby businesses or events.

Utilize Innovative & Emerging Noise Control Systems Technology. Educate ACT staff and other relevant City stakeholders on emerging noise mitigation technology that can be used in the public realm and/or within businesses. Set up a pilot grant program that would provide subsidized noise mitigation tools to nightlife businesses located in clusters that receive high levels of noise complaints. Consider similar models such as the City of San Antonio’s Noise Mitigation Program.

Pilot a mediation program to help resolve disputes between residents and businesses using the Mediating Establishment and Neighborhood Disputes (MEND) NYC program as a model.

Opportunity: Empower businesses and event organizers to develop unique programming that elevates the cultural vibrancy of the city

Implement a “pre-vetting process” to ensure business license applicants understand allowable uses and activities for their proposed business location before going through the entire application process.

Consider restructuring business sanctions for lack of compliance. Fines start at $250 to $500, which reportedly have a minimal deterrent effect. Suspension of operations should be a sanction more often leveraged to encourage businesses to follow ordinances regarding alcohol sales, noise, and safety.

Continue leading meetings with relevant City Agencies to make approval and planning decisions on Special Event Permit applications. These meetings have been reported to be highly effective in facilitating inter-agency communication and streamlining the permitting process.

Enhance external stakeholder understanding of the Special Event permitting approval process and better communicate tentative police detail needs and costs by proposed event type, location, and size.

Opportunity: Strengthen Providence’s status as an exciting cultural and entertainment hub for the region

Liaise with tourism stakeholders to ensure that news on business openings, events, and business promotions is shared through local cultural tourism channels.

Protect and advocate for the city’s supply of independently owned venues. Invest in professional development for ACT so its team can stay up to date on trends and best practices pertaining to serving independent venues.

Work with Providence Warwick Convention & Visitors Bureau (PWCVB) to better promote Providence’s nightlife scene as an exciting part of the region’s tourism brand. Marketing opportunities may include creating a landing page specifically for nightlife under the “Things to Do” page on Go Providence’s website and enhancing coverage of Providence nightlife businesses and events through the PWCVB’s social media channels.

Implementation Matrix

| Action Steps | Priority Level | Resource Intensity | Timing | Partners to Support ACT |

| Advocate for more direct support and coordination for the local Life at Night Economy | ||||

| Designate a new position (“Nighttime Manager”) that can serve as the lead liaison between nightlife businesses, employees, residents, and City agencies. | High | Moderate | Near-Term | City Council |

| Work with BOL to publish a 2024/2025 edition of the 2017 “Best Practices: Providence Nightlife” document.* | Moderate | Low | Near-Term | BOL, RI Dept. of Business Regulation |

| Explore the feasibility, as well as stakeholder interest in, the creation of “Life at Night” districts.* | Moderate | High | Mid-Term | City Council, BOL, RI Dept. of Business Regulation, external firm if needed |

| Make it easier and safer to move around Providence at night | ||||

| Organize and lead a task force of stakeholders affected by late-night transportation issues to determine specific late-night transportation needs and partnership opportunities to enhance services for nightlife workers and/or patrons.* | High | High | Mid-Term | Rhode Island Hospital Center, RIPTA, local universities, nightlife business owners, nightlife employees |

| Improve lighting in Downtown to enhance the real and perceived safety of nightlife customers and employees. | Moderate | High | Near-Term | Providence DID, DPW, PPD |

| Mitigate tension around ownership and control of acoustic space | ||||

| Leverage multi-departmental response mechanisms already in place to prioritize noise ordinance enforcement for businesses repeatedly cited for noise violations. | Moderate | Low | Ongoing | Nuisance Task Force, BOL, PPD |

| Continuously explore emerging noise mitigation technology that can be used in the public realm and/or within businesses. | Moderate | Low | Ongoing | BOL, Small Business Division, RI Commerce |

| Evaluate the opportunity to set up a pilot grant program that would provide subsidized sound mitigation tools to nightlife businesses located in clusters that receive high levels of sound-related complaints. Consider similar models such as the San Antonio’s Noise Mitigation Program. | High | Moderate | Mid-Term | City Council, Small Business Division, Providence DID, municipalities with similar programs |

| Continue sending PPD and BOL staff to the Community Noise Enforcement Certification Course at Rutgers University Noise Technical Assistance Center or another certified entity. | Moderate | Low | Ongoing | PPD, BOL |

| Change language around “noise” in City ordinances to “sound” when referring to sounds created by music or people at nearby businesses or events. | Moderate | Low | Near-Term | City Council, BOL |

| Pilot a mediation program to help resolve disputes between residents and businesses using the Mediating Establishment and Neighborhood Disputes (MEND) NYC program as a model. | Moderate | Moderate | Mid-Term | Small Business Division, Neighborhood associations, local business associations |

| Empower businesses and event organizers to develop unique programming that elevates the cultural vibrancy of the city | ||||

| Collaborate with BOL and business owners to implement a “pre-vetting process” to ensure business license applicants understand allowable uses and activities for proposed location before going through the full application process. | Moderate | Moderate | Near-Term | BOL |

| Assess opportunities to restructure business sanctions for lack of compliance. | Moderate | High | Mid-Term | BOL, RI Dept. of Business Regulation |

| Continue leading meetings with relevant City agencies to make approval and planning decisions on Special Event Permit applications. | High | Low | Ongoing | BOL, PPD, DPW, Fire Department |

| Strengthen Providence’s status as an exciting cultural and entertainment hub for the region | ||||

| Liaise with tourism stakeholders to ensure that news on business openings, events, and business promotions is shared through local cultural tourism channels. | Low | Moderate | Near-Term | PWCVB, Providence Tourism Council, External firm, if needed |

| Protect and advocate for the city’s supply of independently owned venues. Invest in professional development for ACT so its team can stay up to date on trends and best practices pertaining to serving independent venues. | Moderate | Low | Near-Term | National Independent Venue Association |

| Advocate to improve marketing of Providence’s nightlife. Strategies may include more dedicated online landing pages and social media. | Low | Low | Near-Term | PWCVB, RI Commerce, Providence Tourism Council |

Note: “Near-Term” represents a 0–3-year target start date. “Mid-Term” represents 3-5-year start date.

*Task is ideally led by the proposed “Nighttime Manager” position

Bibliography

American Public Transit Association, APTA Mobility Innovation Pilot of the Month: Pinellas Suncoast Transit Authority’s Transportation Disadvantaged Late Shift Program, 2019, https://www.apta.com/pilot-of-the-month-pinellas-suncoast-transit-authoritys-td-late-shift-program/.

City of New York Office of Administrative Trials and Hearings’ Center for Creative Conflict Resolution (CCCR) and the Office of Nightlife at the Mayor’s Office of Media and Entertainment. Mediating Establishment and Neighborhood Disputes (MEND) NYC, 2024, https://www.nyc.gov/site/mome/nightlife/mend-nyc.page

City of Providence Department of Art, Culture and Tourism (ACT), PVDx2031: A Cultural Plan for Culture Shift, 2023. https://artculturetourism.com/pvdx2031/.

City of Providence Department of Art, Culture and Tourism (ACT), Best Practices: Providence Nightlife, 2017. https://www.providenceri.gov/wp-content/uploads/2017/05/Best_Practices-Providence_Nightlife.pdf.

City of San Antonio Economic Development Department, Noise Mitigation Program, 2024, https://www.sanantonio.gov/EDD/Programs-Grants/Noise-Mitigation-Program

Go Providence, History of Providence, 2024, https://www.goprovidence.com/things-to-do/historic-providence/providence-history/

Massachusetts Bay Transportation Authority, Early Morning and Late Night Service Becomes Permanent, Feb. 18, 2020, https://www.mbta.com/projects/early-morning-and-late-night-bus-service-pilots/update/early-morning-and-late-night

Short North Alliance, Employee Mobility Benefits Program. 2024, https://shortnorth.org/wp-content/uploads/2023/05/2023-Employee-Mobility-Menu_5.4.pdf

Urban Studies Journal, Governing the night-time city: The rise of night mayors as a newform of urban governance after dark, November 2019, https://sociablecity.info/cms/resources/publications/governance/governing_the_nighttime_city.pdf

Washington Metro Area Transit Authority, After Hours Commuter Service Program, 2024, https://www.wmata.com/service/After-Hours/index.cfm

For More Information

The City of Providence’s Department of Art, Culture and Tourism (ACT) is responsible for coordinating various cultural activities and serving as an intermediary between nightlife establishments, residents, and other City agencies. ACT supports a vision for Providence as a “global destination for arts, humanities, and design, where neighbors celebrate diverse cultural and artistic experiences, and where all residents and visitors feel that a relationship to arts practice, making, and culture is a part of their everyday lives.” For more information about ACT and this study, visit artculturetourism.com.